BlockFi Review – BlockFi interest Rates

Pros

Positive aspects of the game- No minimum amount on savings accounts

- BlockFi has the best rates compared to conventional banking

- No monthly fees

- Accepts USA citizens

Cons

The disadvantages we highlight- Loans are only issued in USD

- Loan conditions limited to 12 months

- There is one free withdrawal per month, after which there is a 0.0025 BTC withdrawal fee.

10 minutes

BlockFi is not able to operate business as usual as of 11th of November 2023. We have limited platform activity, including pausing client withdrawals as allowed under our Terms. We request that clients not deposit to BlockFi Wallet or Interest Accounts at this time.

Most of the crypto investors keep their digital assets in cold storage or exchanges for a long time. However, it doesn’t help investors in growing their holdings or make overall wealth. The interest account at BlockFi allows investors to keep their holdings on the platform and at the same time earn interest from their crypto being held on BlockFi. The signup process at BlockFi takes only 2 minutes and you can start earning from the same day.

Overview:

Few high-yielding saving accounts hardly break the APY mark of 1.00%. This percentage cannot even keep up with the inflation. So what should be your alternatives for higher yield? A stock market is an option. However, if you are a cryptocurrency trader, you can use other options.

BlockFi is a crypto financial platform that enables you to earn annually up to 9.3% on your cryptocurrencies. That’s more than 8X best rates of saving account.

Products offered:

Following products are offered by BlockFi:

Interest:

BlockFi offers an interest account for holding your cryptocurrency. Interest is added daily and paid on a monthly basis. There are no minimum balances, no hidden fees, and no reason to wait.

Trading:

You can sell, buy or exchange a wide range of cryptocurrencies at reasonable prices. You can start getting interest the moment you trade.

Crypto loans:

BlockFi lets investors borrow funds against their crypto assets while holding them. So, you don’t need to sell your crypto assets to get cash. You can borrow money at the lowest rates of 4.5% APR.

Credit card:

If you use a credit card, you can get up to an indefinite 1.5% back in bitcoin as a reward on your every purchase. You can earn $750 or more through bonus bitcoin rewards.

BlockFi interest account:

The interest rates at BlockFi are extremely competitive, especially in the case of simply keeping cryptocurrency on any interest-free exchange.

- Bitcoin: You can earn an annual interest of up to 6% on deposits below 2.5 BTC and any amount above 3 BTC, you can get 3% interest.

- Litecoin: Earn up to 6.5% interest annually on all your deposits

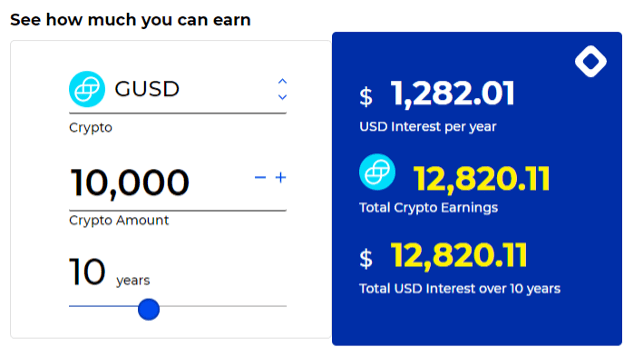

- Gemini dollars: Earn 8.6% interest on USDC deposits

- Ethereum: Earn up to 5.25% interest annually on ETH deposits

- Chainlink: 5.5% interest on any deposits

- USDC Dollars: Earn 8.6% interest on USDC deposits

- PAXG: Earn 5% interest on PAXG deposits

- BUSD: Earn 9.3% interest on USDT deposits

- PAX: Earn 8.6% interest on PAX deposits.

- USDT: Earn 9.3% interest on USDT deposits

Interest rates are paid in the nominal cryptocurrency. In a year, on 1 BTC you will earn 0.06 BTC, provided that the interest rate will stay the same. For people who are in the cryptocurrency market for a while now, they can better understand the pros and cons of having a volatile asset, the 0.06 BTC can be more or less than the equivalent USD at the moment of depositing.

However, earning an interest rate of 8.6% on stable coins i.e. Gemini dollar prevents some volatility risks. It is also important to note that BlockFi charges a withdrawal fee. Withdrawal fees will be cut from the total withdrawal amount and users get 1 withdrawal free of charges every month.

Interest account opening is simple:

- Put your information to open a new interest account at BlockFi

- Deposit USD by connecting your bank, stablecoin, or crypto

- Get your interest payment per month

The interest account of BlockFi allows companies and individuals that own crypto assets to get interest on their assets held at BlockFi. Making an interest account is simple and takes only 2 minutes and you can start earning from the very moment you made an account. The earned interest increases the annual yield of clients. For example, with a 6% interest value, if you deposit 1 bitcoin on 28 Feb, you will have 1.005 bitcoin by the end of March. This procedure will repeat each month till you withdraw your funds.

Crypto Loans

BlockFi enables you to borrow money by depositing your coins. The minimum amount you can loan is $5000. The loan-to-value (LTV) ratio is 50%. It means the remaining 50% of your coins will be placed as collateral.

Coins that you can use include ETH, LTC, and BTC. The duration of the loan process is 12 months and the interest rate on it will be 4.5%. Original fees can also be charged.

As we all know cryptocurrencies are so volatile, you can rapidly drop out of the 50% LTV. If the LTV reaches 70%, then it’s a trigger event, you will get a notification from BlockFi to place more collateral so that LTV drops back to 50%.

Borrowing cash through BlockFi crypto loans is secure, fast, and easy. You can receive your funds on the same business day and you don’t need to pay penalties or fees at repayment.

You can invest in different assets by using crypto-backed loans. It is a famous option to broaden your portfolio.

BlockFi bitcoin reward Visa credit card:

You can earn bitcoins as a reward from BlockFi. BlockFi gives amazing opportunities to its users to earn while trading:

- You can earn bitcoin worth $250 as a reward for spending $3000 within the first 3 months.

- In 4-6 months of card ownership, you can earn 3.5% bitcoin rewards on all your purchases.

- You can get 2% extra APY on the daily stablecoin balance that is paid in bitcoin for up to $200.

- Get 0.25% back in bitcoins for all your eligible trades, with a maximum of $500 return each month

- $30 in reward for referring a friend

Trading:

BlockFi makes trading easy with reasonable costs. It lets you sell, buy and exchange cryptocurrencies such as ETH, LTC, PAXG, and BTC as well as stable coins such as USDT, GUSD, PAX, and USDT. It’s up to you to choose the currency you want.

Trading on BlockFi is cost-effective and instant. As soon as the trade is executed, it will be shown in your interest account. You will start earning interest instantly on your assets. For example, you can earn interest at the BTC rate, if you use dollars to buy bitcoin.

To make a trading account at BlockFi, you are just 3 steps away:

- Signup for an account

- Fund your account

- Click the trade button from the dashboard and start trading

BlockFi Mobile App

BlockFi has exceptional apps for android and iOS. It helps to manage the account anytime. You can view your trade, borrow money, earn interest and balance among other features on the go without needing the desktop platform.

Some features of a mobile version of the BlockFi platform include:

- Sign up and earn: you can use the mobile app to sign up for BlockFi. You can make an account through android and iOS devices and start earning.

- Get up to 8.6% APY: mobile users can also get up to 8.6% APY on all their holdings as they have the same version as desktop users. Currently, BlockFi pays 6% APY on bitcoins and 8.6% APY on stable coins.

- Borrow Money: you can use your crypto to take a loan from the platform through your mobile app. You can withdraw a loan in the form of USD, without selling your crypto.

- Manage Everything: mobile app let you manage all the features, services, and products easily on your mobile phone without needing the desktop platform.

How Do I Open An Account?

For opening an account at BlockFi, you will be required to upload clear photos of identification documents. The platform claims that most applications get approved within minutes.

Once your account has been created, you can link your bank with it and transfer funds right away through ACH. For new accounts, they can transfer a maximum of $500 in a day and established accounts can transfer $1000 in a day. This limit can increase in the future.

The depositing process can take up to 5 business days.

BlockFi Fees:

BlockFi charges a fee for withdrawing currency from the account. Nonetheless, you can avail of one free withdrawal in a month. After that, you will be charged a fee as listed below:

- ETC — 5K for every 7-day Period @ 0.0015 ETH

- Stablecoins — 1M for every 7-day Period @ 0.25 USD

- BTC — 100 for every 7-day Period @ 0.0025 BTC (overall ~$30)

- LTC — 10K for every 7-day Period @ 0.0025 LTC

Minimum withdrawals imposed by Gemini are:

- 0.003 BTC

- 0.056 ETH

BlockFi safety:

BlockFi doesn’t keep your money as safe as it is in a bank because neither BlockFi nor its custodian, Gemini is protected by SIPC and FDIC.

However, Gemini does take some security measures to protect funds. Those security measures include using cold storage to save funds. Moreover, BlockFi also claims that it puts client funds ahead of any employee or equity funds in the case of loss.

Licenses:

In addition, BlockFi is among one of few crypto-interest-earning retail-focused platforms. it is regulated and domiciled in the US, doesn’t have utility tokens, and is institutionally backed. The platform has some rules for the company and the customers.

BlockFi Alternatives

| Platforms | Features | Start Earning |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conclusion:

BlockFi is worth investing in or not and is linked to what you want to do with your cryptocurrency. The interest rates at BlockFi are very competitive for the industry. Without doing anything, your 10 BTC will turn into 10.62 BTC in a year, that’s a significant gain of $5000.

However, you must also be prepared for the losses in case of any catastrophic hack of BlockFi or Gemini as its security features are not so exceptional.