Margex review – Crypto Leverage Trading Platform

Pros

Positive aspects of the game- Deposit bonus up to $100

- No KYC

- Easy interface

- Leverage up to x100

Cons

The disadvantages we highlight- Limited trading pairs

- Listed crypto:

- Margex registration:

- Deposit method:

- Margex features:

- Trading pairs and leverage

- What is crypto Copy Trading?

- How to Copy Trade on Margex!

- Choose a Trader

- Click follow

- Choose an amount

- Confirm and start copying

- Powerful trading engine:

- Deep liquidity and minimum slippage:

- Margex video tutorial

- Margex leverage:

- Fees:

- Margex Bonus:

- Margex security

- User account security:

- Custodian security measures:

- Trading infrastructure security measures:

- Fraud prevention and price manipulation:

- Is Margex regulated?

- Margex Alternatives

- Summary:

Founded in 2020 and headquartered in Seychelles Margex is the fastest latest derivative trading platform where you can open both short and long positions with a leverage of up to 100x on crypto trading pairs.

Margex connects the liquidity of over 12 exchanges in one place and creating a lively and deep order book, which makes the best entry prices and exit prices available. This creative feature ranks Margex instantly among most liquid trading platforms and enables the customers to place big orders without experiencing any price sways or slippage.

Listed crypto:

As Margex is new in the market so currently its supports limited but major currency pairs such as BTC/USD, LTC/USD, UNI/USD, ETH/USD, SOL/USD, XRP/USD, ADA/USD, and EOS/USD.

Margex registration:

The registration process at Margex is very simple and can easily be understood by beginners. It only takes 2 steps to register and no more than 30 seconds. You can start your trading experience within a minute.

- You just need to click on the “trade now” tab on the homepage of Margex. It will take you to the registration page for creating an account.

- Fill in the required information such as email address and password and click on the register and there you go.

- You will receive a confirmation link on your email address and confirm your registration at Margex.

- You don’t need to give identity proof or proof of address.

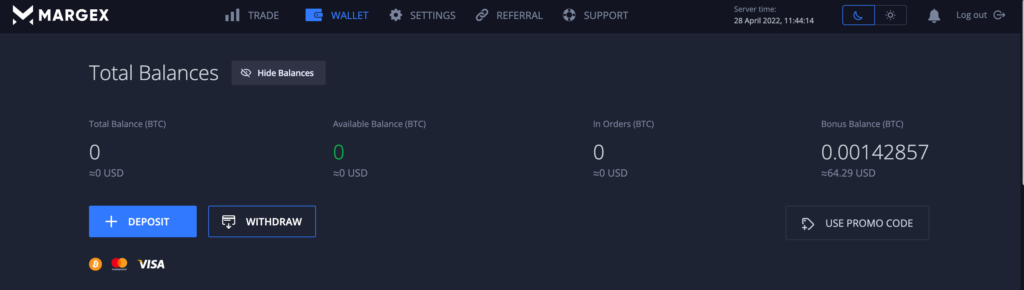

Deposit method:

For depositing, you just need to open a “wallet” page and press “deposit”.

At Margex, two methods are available for depositing your funds.

- You can directly deposit bitcoin to your personal account and then transfer them to your Margex account wallet. Then copy your BTC address from Margex and paste it on the destination field in the wallet/site from where you want to transfer funds.

- On the other way, you can use your bank card to buy bitcoin via Changelly. Just enter in the amount and currency you want to pay with. Press “exchange” and it will take you to Changelly where you can fill in your payment details and complete the process.

Margex features:

Futures

An investing tool known as a futures contract is a financial derivative that enables traders to gain from an underlying asset's performance. You can follow the price of BTC and enter into long (buy) or short (sell) bets with a Bitcoin futures contract.

In this situation, Bitcoin or any other virtual currency, a trader gains if the underlying asset increases (if you are long) or decreases (if you are short). While some futures contracts have an expiration date, others are meant to be traded forever.

Types Of Crypto Futures Trading

You should be knowledgeable about the various crypto futures trading contracts, including Bitcoin, before you start trading. Every one of them has benefits and drawbacks.

Standard Bitcoin Futures contracts

The most typical type of contract for futures. This type of agreement gives traders a deadline, or period of expiration, by which one of the parties is required to purchase the underlying asset. These include digital money, gold, silver, and other precious metals, as well as equities like stocks and commodities.

Based on their expiration date, these futures contracts are more appropriate for long-term traders or traders using low-volatility assets with specific goals in mind.

Futures with physical delivery

Futures-backed contracts, in contrast to regular and perpetual contracts, require one of the parties to the transaction to physically receive the underlying asset. These contracts are mostly used as hedges or by optimistic investors to buy assets that are on sale today and resell them for a profit later on.

Speculators or investors with a private agreement with a second party and the necessary infrastructure to store the underlying asset are the ideal candidates for these futures products. There are high expenses in the contract, like carrying and delivery charges.

Perpetual Bitcoin Futures contracts

In the field of crypto perpetual futures and perpetual swaps are the most widely used contracts. With the help of Margex traders, investors can profit from bullish or negative movements by going long or short on Bitcoin or other digital assets.

Perpetual futures contracts are more cost-effective for traders and do not have the trade-offs associated with other contract types. However, the level of leverage and margin necessary to place the long/short order can make them riskier. They therefore give you the opportunity to make gains or losses really quickly.

Trading pairs and leverage

With up to x100 leverage on Margex cross margin and isolated margin, trade long and short with the most liquid assets, including as BTC, ETH, LTC, XRP, EOS, ADA, UNI, SOL, and more.

Margex now provides the most liquid trading for cryptocurrencies:

- BTC/USD

- ETH/USD

- BNB/USD

- XRP/USD

- LTC/USD

- EOS/USD

- ADA/USD

- SOL/USD

- UNI/USD

- MATIC/USD

- LINK/USD

- BCH/USD

- APT/USD

- DOT/USD

- ATOM/USD

- MANA/USD

- XMR/USD

- SUSHI/USD

- LINA/USD

- OP/USD

- ARB/USD

- MTL/USD

- CFX/USD

- DOGE/USD

- 100KPEPE

- 1KSHIBUSD

- AVAXUSD

- APEUSD

- ETCUSD

- SUIUSD

- COMPUSD

- FILUSD

- CRVUSD

- AAVEUSD

- NEARUSD

- AUDIOUSD

Based on the liquidity and trader demand for a specific asset, the list of possible trading pairs and conditions is evaluated and updated on a regular basis.

On the Trade page, all of the possible trading pairs are displayed and can be chosen from the corresponding drop-down menu at the top.

What is crypto Copy Trading?

With the groundbreaking new trading feature of “crypto copy trading,” users of all skill levels may connect with seasoned traders and duplicate their profitable deals. On bitcoin trading platforms, Copy Trading is growing in popularity despite being a relatively new function.

How to Copy Trade on Margex!

Choose a Trader

Examining every trader's history and all of the information on the Margex Copy Trading platform is necessary to determine which trader is best for you. Make careful to take into account traders that fit your desired level of risk and profit. A competent trader who is worthy of imitation should also have a history of safe trading methods and consistent results.

Click follow

This is the simple part. With a single “Follow” click, Margex's cutting-edge Copy Trading program will automatically copy every trade performed by the chosen trader. For a well-rounded copy trading portfolio, users can also follow numerous traders simultaneously.

Choose an amount

It is up to followers to choose how much money to invest in following a trader. You should carefully consider how much money you wish to use to follow the trader before entering it into the copy trading platform.

Confirm and start copying

Once you've reviewed all the information, click “Follow” to finish the process and begin benefiting from the experience of more seasoned traders.

Margex offers an elegant, easy-to-follow, and simple user interface. As margin trading is not beginners friendly, the derivative platform suits a lot of people with different experience levels to be capable of creating an account and start trading on digital currencies.

Powerful trading engine:

you will get a trading experience like never before. You will not face any “order submission errors” or any capital loss because of delayed orders. The trading engine of Margex can simultaneously process over 100,000 trades with an average order execution time of 8 ms.

Deep liquidity and minimum slippage:

The liquidity system that Margex offers is unique and only one of its kind in the industry of crypto. Margex combines the liquidity from 12+ best liquidity providers of the world into one deep order book. This feature allows minimum slippage, deep liquidity, best entry and exit prices, thinner spreads, and instant order execution.

Margex video tutorial

Margex leverage:

The platform enables 100x leverage/margin on every trade. It means that you can borrow money from the platform to purchase a financial instrument. Simply put, it is a loan that you take from the exchange to purchase more bitcoin contracts that otherwise you cannot buy.

Fees:

Whenever you place an order at Margex , you will have to pay either a taker fee or a maker fees.

Taker fees:

It is charged when liquidity is removed by placing an order which immediately matches an order from the order book i.e. conditional order that is converted to market order after execution, for example, stop market order or stop loss. You will be charged a taker fee of 0.060%.

Maker fees:

It is charged when liquidity is added by placing an order that is delayed and not matched with any order in the order book. For example, if a limit order is placed above a current price then it will be a SELL order or below a current price make a BUY order. You will be charged a 0.019% maker fee.

Funding rate fees:

It is an interest cost that is charged if you borrow Margex assets to the leveraged trades and charged every 8 hours. There will be no funding rate fee if a position gets closed before a funding cut-off time. Funding rates vary among longs and shorts. Short funding fees range between 0.18%-0.40% and long funding range between 0.15%-0.30% based on the crypto you are trading.

Margex Bonus:

You will receive a bonus of $50 when you sign up and register by using the Margex link. You can also get an extra $50 bonus after depositing 0.004+ BTC or more. These bonuses cannot be withdrawn and can only be used for covering trading fees. However, any gains generated using a bonus for trading are yours totally.

Margex security

User account security:

Margex uses the 2FA (factor authentication) technique for securing the funds of users. It keeps the funds secure even if your one-step security is exposed or hacked. It also takes email confirmation for all your withdrawals. All the data transfer is SSL encrypted as well as email alerts/notifications to keep you aware. All your sensitive information or account data is encrypted through special protocols. 24/7 chat or email support to answer your queries.

Custodian security measures:

All your assets are kept in offline cold storage. Monitoring of all assets movement is done in real-time. You can also access the segregation system, which avoids the risks of malicious attacks from the company employees.

Trading infrastructure security measures:

Server infrastructure is elastic, capable of scaling up instantly during peak hours and it also provides instant execution speeds and order matching, with lower latency for each customer globally. Margex also uses DDOS protection system which protects the exchange from overloading if hacking attempts are made.

Fraud prevention and price manipulation:

Suspicious trading activities are monitored and handle by Margex real-time machine or a system (MP Shield system). Margex doesn’t add assets that are highly affected through manipulations and have low liquidity. There also operates a protection system for prices that place your order at the price that you expect.

Is Margex regulated?

Margex is not regulated till now as it is headquartered in Seychelles, where no regulation or license is required for bitcoin trading. However, they still provide the same security level as any other regulated platform.

Margex Alternatives

Summary:

Margex is becoming a great crypto derivative platform over time through its unique approach. It is a user-friendly platform and offers security, high quality, and stability. Margex stands out among its competitors due to its innovative systems such as protection systems and MP shield. Additionally, it requires no KYC and prevents traders from unfair liquidation. With high leverage, low fees, and security standards, Margex is fresh air in the crypto derivative space.