Admiral Markets Review (Admirals) – Trading Platform

Pros

Positive aspects of the game- Support MT4/MT5

- Advanced trading tools

- Negative balance protection

- over 8000 instruments to trade

Cons

The disadvantages we highlight- Not available in the US

- Regulation:

- The UK Financial Conduct Authority:

- Estonian Financial Supervision Authority (EFSA):

- CySEC in Cyprus:

- Australian Financial Services Licence (AFSL):

- Available financial instruments:

- Admiral Markets Leverage

- Trading platforms:

- Metatrader Supreme edition:

- Mobile App

- Account types:

- Opening an account:

- Account base currencies:

- Admiral Markets Fees:

- Deposit and withdrawal fees:

- Admiral Market Minimum Deposit:

- Bonus and promotions:

- Payment methods:

- Summary:

10 minutes

Admiral markets(rebranded to Admirals) trading firm operates under the Admiral Markets trademark and provides trading services all around the globe. It offers trading with CFDs in forex, cryptos, metals, agriculture, ETFs, indices, energies, bonds, and stocks.

Admiral Markets give the most transparent experience of trading by giving access to highly functional software. The broker uses external auditors to increase its internal and operational procedures to ensure regulatory compliance.

Founded in 2001, the broker is now expanded to the whole world and offering services through its trading companies worldwide.Now it has changed its name to “Admirals”. Its presence in different geographical regions provides support and intelligent services to their clients wherever they need it.

Regulation:

Admiral Markets are regulated by multiple authorities or jurisdictions. They are as follows:

The UK Financial Conduct Authority:

Admiral Markets UK Ltd is regulated by FCA (financial conduct authority) under registration no. 595450. It is authorized to hold the money of clients under the rules of FCA CASS.

Estonian Financial Supervision Authority (EFSA):

The Admiral Markets AS is authorized and licensed by EFSA under a license number (4.1-1-1/46) for brokerage activities and main investment in the European Economic Area (EEA) and European Union.

CySEC in Cyprus:

Admiral Markets Cyprus Ltd is regulated by CySEC under license no. 201/13 in Cyprus. It provides ancillary and investment services along with financial instruments that the company is authorized to deal with.

Australian Financial Services Licence (AFSL):

Admiral Markets Pty Ltd holds a license from Australian Financial Services with (ABN 63 151 613 839) to support a business of financial services in Australia. It is limited to financial services that are covered by its AFSL number. 410681. The data available on its website is for people from around the globe, the information may vary according to your country's regulations and laws.

Available financial instruments:

More than 8000 markets worldwide are available through CFDs, which includes:

Currency pairs CFD (forex):

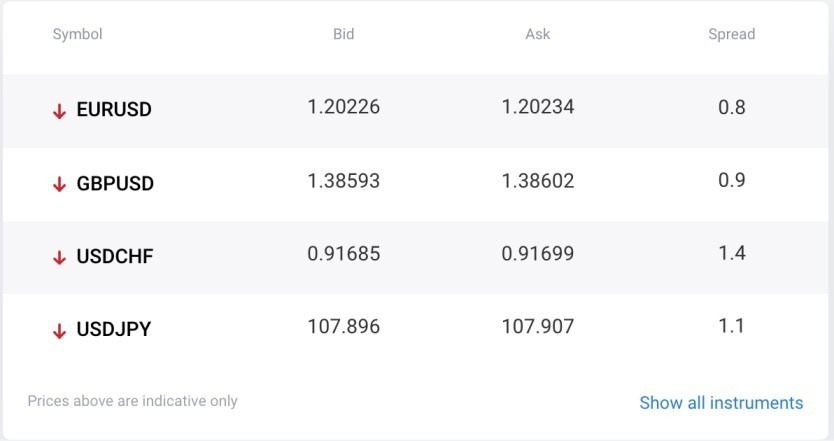

You will get access to 50 currency pairs while trading with Admiral Markets as well as the lowest spreads 0.6 pips on professional accounts. The highest leverage of 1:30 is available for European and UK clients. For international clients, leverage is 1:500.

Commodities CFD:

You can trade different commodities at Admiral Markets such as metals, energies, and agriculture. More than 28 instruments are available for trading that includes oil, sugar, silver, natural gas, and cotton. Trade with leverage of up to 1:20. Leverage of up to 1:500 is available for international clients.

Indices CFD:

Admiral Markets provide access to 43 leading stock markets including the few most liquid in the world. You can get leverage of up to 1:10 for trading indices. International clients can trade with a leverage of up to 1:500.

The benefit of selecting Admiral Markets is getting huge diversity as you can access markets of the United Kingdom, Hong Kong, Japan, Netherlands, Norway, Australia, China, Germany, Swiss and more.

Stocks CFD:

Due to the broker's global market access, you can get plenty of opportunities to trade stocks.

In the case of stock CFDs, international customers can trade more than a hundred listed companies from the UK, French, US, and German stock markets. You can get leverage up to 1:50.

Crypto CFD:

You can get access to many crypto while trading with Admiral Markets such as Bitcoin (BTC), Ethereum (ETH), Stellar (XLM), Litecoin (LTC), Ethereum Classic ( ETC), XRP, Monero (XMR), DASH, Zcash (ZEC), and Bitcoin Cash (BCH).

You can trade with leverage of up to 1:2 and international clients can trade with leverage of up to 1:5.

Bonds CFD:

You can get access to US and german 10 years bonds if you trade with Admiral Markets.

Admiral Markets Leverage

- Forex – Leverage for retail customers is 1:30. leverage can go up to 1:200 for Professional customers. For customers under the Seychelles entity, leverage can go up to 1:1000 for international customers.

- Commodities and indices – For retail customers the maximum leverage can be 1:10. For the professional customer, the maximum leverage can be 1:200

- ETF – Maximum leverage is 1:5 For customers under Seychelles entity and professional customers it can go up to 1:20

- Crypto – 1:2 maximum leverage: For professional customer and client under the Seychelles entity leverage can go up to 1:20

- Stocks– 1:5 maximum leverage, For professional customers, the maximum leverage is 1:20. For customers under the Seychelles entity leverage can go up to 1:50.

- Bonds: 1:5 maximum leverage. For professional customers, they can trade with leverage of up to 1:200.

Trading platforms:

The advantage of trading with Admiral Markets is getting a variety to choose from trading platforms and accounts. It not only offers top-notch trading platforms like MT4, MT5 but also offers customized platforms designed according to your trading needs allowing a more personalized experience.

MetaTrader4:

MT4 is a famous, fast, reliable, and professional trading platform specifically for CFDs and forex. It can be downloaded on windows and mac devices.

It has the following features:

- Rich historical data

- One-click trading

- Customizable indicators

- Advanced charting

- Various time frames

MetaTrader5:

MT5 is the latest version of MT4 and designed for more professional traders. With a fully customizable interface and advanced technical tools for analysis, it is an all-around platform. The features include:

- Level 2 pricing

- Education market

- VPS support

- Live news feeds

- Free market data

MetaTrader 5 guide

Discover how you can trade online using the MetaTrader 5 app in this tutorial!Metatrader Supreme edition:

This trading platform has advanced tools and features to enhance trade operations. It offers award-winning technology of pattern recognition, technical analysis indicators, day trading strategies, and holding timeframes. It can manage multiple orders and currencies at one time due to its powerful widgets and add-ons.

Metatrader Web trader:

It is an easy web-based platform. Moreover, it allows its users to trade anywhere with only an internet connection. It enables straightforward trade management and price analysis. You can get access to a variety of indicators, such as Bollinger Bands and pivot points as well as a forex pip calculator.

The platform also facilitates famous strategies such as hedging and one-minute scalping.

Mobile App

A functional mobile app for Admiral Markets is available both for Android and iOS devices. It gives traders access to three chart types, news releases, live price feed, trading journal, and custom indicator. The user interface of a mobile app can also be customized.

Account types:

There are two main account types:(MT4/MT5) which the only charge spread. The spreads for zero account types of MT5 and MT4 start from zero and also there is commission on few instruments.

Trade.MT5:

- Commissions: 0

- Hedging: Available

- Islamic account option: Available

Zero.MT5:

- Commission:Metals and forex – from 1.8 to 3.0 USD for each 1.0 lots

- Cash Indices – from 0.15- 3.0 USD for each 1.0 lots Energies – 1 USD for each 1.0 lots

- Hedging: Available

- Islamic account option: Not available

Trade.MT4:

- Commission: 0

- Hedging: Available

- Islamic account option: Not available

Zero.MT4:

- Commission: Metals and forex – from 1.8 to 3.0 USD for each 1.0 lots

- Cash Indices – from 0.15 to 3.0 USD for each 1.0 lots

- Energies – 1 USD for each 1.0 lots

- Hedging: Available

- Islamic account option: Not available

Admiral Markets Demo

A demo account is a type of account provided by Admirals that is funded with virtual money and allows a prospective customer to experiment with the trading platform and its various features before deciding to open a real account funded with the customer's real money.

Opening an account:

The account opening process for Admiral Markets is easy and quick. The online application form takes only a few minutes to complete. You would have to verify your email address and then upload a clear picture of your driving license or passport and utility bill to confirm your address. Once your account gets verified, you can deposit it in your account and start trading.

Account base currencies:

There are 8 base currencies available at Admiral Markets. You can choose from BRL, MXN, CLP, THB, VND, USD, EUR, SGD.

Admiral Markets Fees:

Admiral Markets offer two distinct accounts with different pricing structures. One takes no commission with higher spreads for base currency pairs. The other account charges fees with significantly lower spreads. Equity ETFs and CFDs carry a commission.

Charges depend on your monthly trading volume in your account. Swap rates are applied on leveraged overnight positions. Every month, €10 is charged if you stay inactive for 24 months and 1% currency conversion charges are also applied.

The lowest spreads of 0.1 pips are available for MT4/MT5 zero accounts but the broker will charge commission.

Deposit and withdrawal fees:

Deposit fees:

Admiral Markets don't charge deposit fees for different payment methods except for skrill and Neteller, for them, the broker charges 0.9% on their deposits.

Withdrawal fees:

Admiral Markets offer 2 free withdrawals every month for all payment methods except bank transfer, for this broker offers 1 free withdrawal.

Admiral Market Minimum Deposit:

$100 is the minimum deposit amount for Admiral Markets. However, the recommended initial amount is $1000.

Bonus and promotions:

For clients under the Seychelles entity, the Admiral Markets offers100% bonus and cash back.

*It is not applicable for European clients.

You can get bonuses and special offers if you become professional clients at the broker.

Payment methods:

Only three payment methods are supported by Admiral Markets, which includes:

- Credit/debit card

- Skrill

- Bank wires

Summary:

Over the years, Admiral Markets have established a reputation as a reliable broker. Now it operates in 110 countries with a home to more than 120,000 traders.

It has customizable trading platforms, a wide range of assets, good regulation, and automated trading support that makes it different from other brokers.

Along with outstanding features, it has a simple design and easy-to-use trading platforms. Overall it is a legit broker, you will not regret your decision of trading with Admiral Markets.